Why do our stables keep failing?

Terraform Labs co-founder Do Kwon was wrong about a lot of things. But he was right in his belief that a decentralised economy needs decentralised money.

While Crypto gave us a lot of excellent protocols and tokens, they remain too volatile to serve as a proper medium of exchange. Imagine spending 0.1 AVAX on coffee to learn the next day that its value has risen by 1000% overnight. The case for stablecoins is pretty straightforward. Blockchain users need an asset that is “pegged” to some sort of stable value (usually 1 US Dollar).

As of Summer 2022 total market capitalisation of stablecoins exceeds that of Ethereum despite a lot of fear and uncertainty around some of them.

Stables are regularly called a “killer app” of crypto, which will help onboard hundreds of millions of users into DeFi. There is, however, still a lot of controversy surrounding them. We have yet to see the "ultimate" decentralised money that Do promised. So let us dive a bit deeper into the world of fiat-pegged assets and try to understand their past, present and future.

How did we get here?

Origins of modern stablecoins can be traced back to 2014 when the first two - BitUSD and NuBits emerged. The former was collateralised with BitShares cryptocurrency. The latter was algorithmic with some reserves in Bitcoin. It is enough to say that both of them lost their peg years ago and are no longer with us.

2014 was also the year that saw the birth of Tether (originally called Realcoin). Their dollar-pegged USDT was the first stablecoin with off-chain backing. Each token issued on the blockchain is backed by at least 1$ worth of real-world assets (e.g., cash, cash equivalents etc.).

Since then, a lot of tokens with similar designs were issued. The most well-known ones include Binance USD (BUSD) and USD Coin (USDC). They will have different reserve compositions and structures. The core design, however, remains the same - one authority that controls the issuance and holds all the funds.

These centralised stablecoins have been under a lot of criticism for their opaque workings. For many people, the ability of issuers to freeze wallet funds is also a major concern. Although done for regulatory compliance, it gives them too much control.

How do we fix this?

As an alternative to these centralised fiat-backed tokens, many solutions were developed. The most successful of them to this day is MakerDAO’s DAI, released in 2017. Users were given the ability to lock Ether into the smart contract and borrow DAI against it. They could also repay 1 DAI to “unlock” 1$ worth of ETH. This mechanism, called Collateralised Debt Position (CDP), is completely on-chain and transparent. Anyone can mint DAI or audit the protocol reserves.

Many CDP protocols like Moremoney, Liquity and Yeti Finance now exist. They are an integral part of DeFi's future and have billions in collective TVL. There is, however, one big problem: capital efficiency.

For protocols like Maker to remain safe and solvent value of the tokens deposited must be higher than the value of issued stablecoins. This gives them some space to work with in case of liquidations and bank runs.

Why no one has fixed it yet?

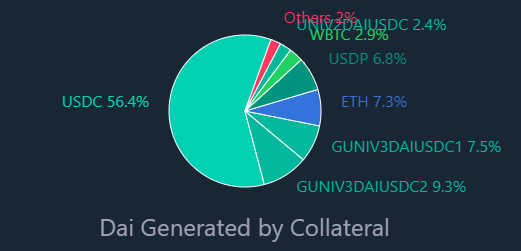

Another problem for CDP coins is their over-reliance on centralised peers for collateral. For example, more than 50% of DAI is backed by USDC.

This is convenient for protocols and users since they know that most backing won’t suddenly devalue and crash the peg. The issue is that it brings us back to square 1 in terms of decentralisation. If the DAI is basically wrapped USDC, what’s the difference?

Thus, when thinking about theoretical “ideal” stablecoin, we must consider three factors:

Is it decentralised? - Is there one party that controls all processes and all collateral?

Is it capital efficient? - How much value needs to be “locked away” to mint one token?

Is it stable? - What mechanisms exist to ensure that the token price will remain constant?

In a traditional crypto manner, these factors form the “stablecoin trilemma”. The protocol can have one or two but not all three simultaneously.

Now infamous UST has tried to solve it by letting anyone mint and burn it (decentralisation). It also wasn't collateralised at all (maximum capital efficiency). It also tried to tackle the stability by building up Bitcoin reserves to backstop the peg. Yet, it wasn't enough and the token depegged, wiping out billions over a few days.

Is all hope lost?

While building a stablecoin that meets all three criteria is difficult, it is not impossible. A lot of work is being done on that front by teams on different chains:

Frax Finance have developed fractional reserves stable on Ethereum. Their token started as 100% backed by assets like USDC and ETH. The design allows it to become partially algorithmic. Right now, the collateral ratio sits at ~90%.

UXD is using positions on Solana's perpetual exchanges to back their token. It opens short positions against user-deposited collateral, creating a delta-neutral strategy. That means that whether the price of collateral moves up or down, the total value would not change. This allows for a collateral ratio of 100%, which is smaller and more capital efficient than the 120%-150% used by CDPs.

Fei Protocol introduced the idea of Protocol Control Value last spring. Rather than having deposits belong to users, the protocol owns and manages all the collateral. It can then use these reserves to guarantee 1:1 redeemability, provide liquidity or yield farm.

Aave have recently announced their GHO stablecoin. It is already the biggest DeFi lending protocol with a presence on multiple chains (including Avalanche!). Having their own stablecoin will help unlock extra liquidity and revenue streams.

On Avalanche's side, Yeti Finance released a Yeti USD (YUSD) token not long ago. It offers interest-free borrowing on yield-bearing collateral. Users can keep earning yield from their LP positions or staked coins while unlocking extra liquidity. Ultimately this leads to improvements in capital efficiency and decentralisation. There is already support for a wide range of deposits with more strategies, including delta-neutral ones coming soon.

Stablecoins might seem like one of the most boring aspects of DeFi and Crypto in general. You can’t speculate or DCA into them. Good stablecoins “simply” work. There are, however, immense amounts of innovation and work put into the space.

Clicked for Shikamaru, stayed for the content. Great piece man!