Where does yield come from, and where does it go?

If you followed DeFi for a while, you are accustomed to the concept of yield. You might even be earning some yield on your tokens. Even in bear markets, we can find ways to earn double or sometimes triple-digit APRs on our holdings. It has hard to imagine returns like these in a world of traditional finance.

But where does this yield actually come from and who is paying for this banquet?

Sustainable vs Unsustainable

First, it's important to understand that not all APRs are made equal. Sources of yield can be divided into two categories: sustainable and unsustainable.

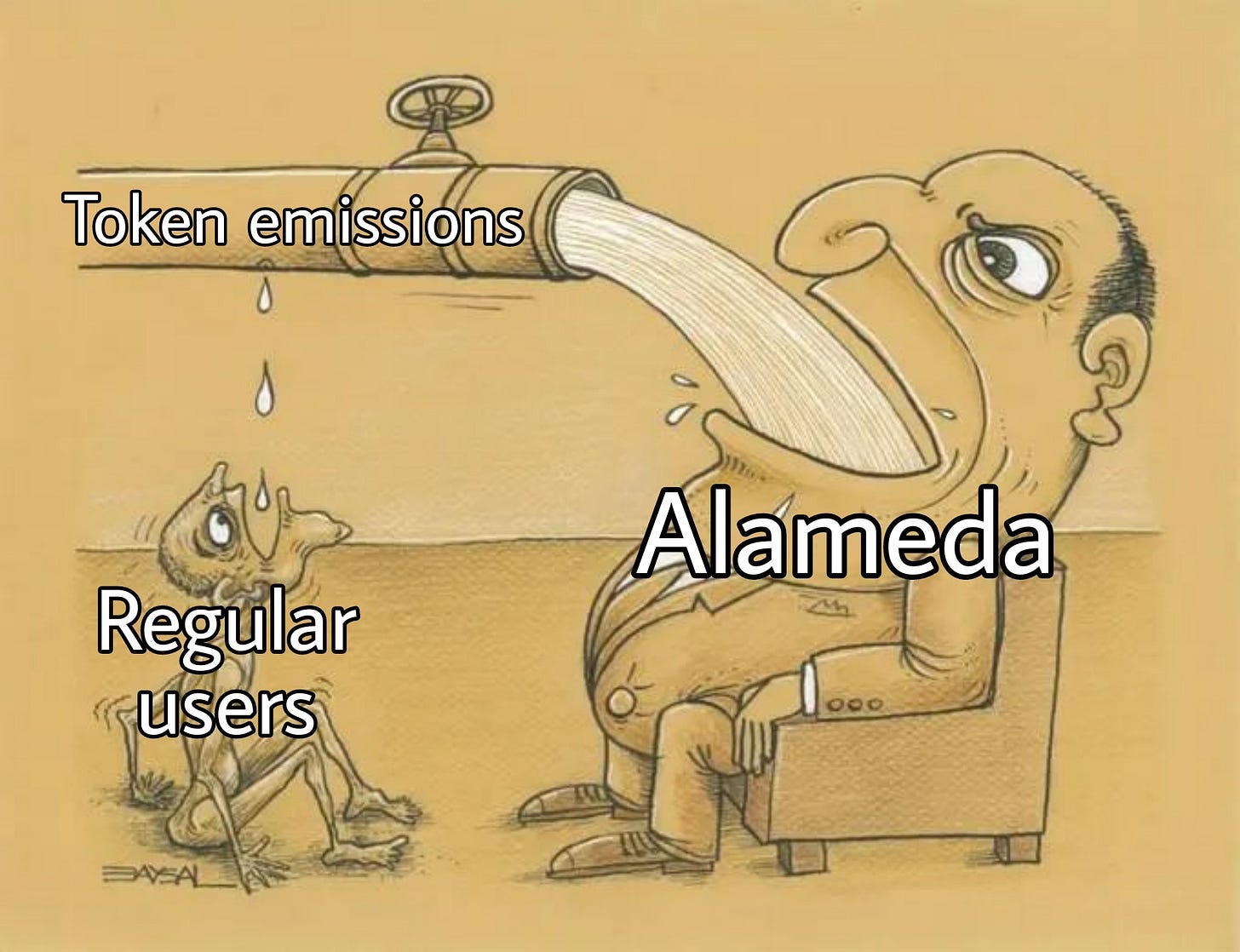

Unsustainable yield usually comes in a form of token emissions, referred to as “liquidity mining campaigns”. These were pioneered by the Compound protocol in 2020 when it started rewarding lenders with its native token. Shortly after more tokens and more campaigns emerged and we now know that period as the “DeFi summer”.

Even whole chains run their liquidity mining campaigns. This way they can attract builders, bootstrap liquidity and gain adoption by allocating part of their token supply to these initiatives.

While liquidity mining can be lucrative for early participants it traps protocols in a self-feeding loop:

Yield farmers incentivised by high APRs come and start earning native tokens. To capture profits they sell these tokens for stablecoins or other assets (e.g., AVAX, ETH, BTC)

Due to all the sales, the price of a token takes a hit and so do the APRs.

As yield dries up farmers start withdrawing their assets. This leaves users and protocols with no liquidity and a devalued native token.

There have been many attempts to make liquidity mining sustainable. Most prominent examples include:

ve-tokenomics (i.e., encouraging yield farmers to lock their tokens);

protocol owned liquidity (i.e., buying liquidity rather than “renting” it).;

It still remains to be seen if these methods are sustainable long term. On the other hand, sources of actually sustainable yield exist and are plentiful. They rarely involve complex tokenomics or rely on native tokens at all. Which makes them safer, easier to understand and more viable for real-world adoption.

Fees and revenues

Many DeFi protocols charge their users fees. It is pretty common, for example, for a decentralised exchange to take 0.3% on each swap. Majority if not all of this fee goes to liquidity providers. It aims to compensate them for taking the risk of Impermanent Loss and actually powering the platform.

While 0.3% might seem small it actually can end up amounting to significant returns for pairs with high volume and demand.

Sometimes decentralised exchanges might take a portion of this fee and keep it as a “protocol revenue”. Often it is shared with native token holders, who are also seen as "stakeholders". This is another example of sustainable and non-dilutive yield.

Trader Joe, for example, charges 0.05% on each swap, uses it to buy USDC and returns it to stakers of the $JOE token. Other protocols can opt-in to using revenues to buy back their tokens from the market instead. These tokens are then either burned or re-distributed to stakers.

Another way for users and protocols to earn non-dilutive yield is by charging for borrowing assets. Protocols like Aave and Benqi require borrowers to pay interest. Liquidity or YetiFinance on the other hand asks for a one-time fee. This approach is similar to traditional banking where lenders are paid by debtors.

Finally, the most basic source of sustainable yield is block rewards to validators. They are paid for securing the network from the gas token (e.g., ETH or AVAX) inflation and fees. On Avalanche users can earn 8-9% in AVAX by delegating or running a validator themselves. Recently, liquid staking alternatives have been becoming more and more popular. They allow users to capture yield from staking while also participating in DeFi.

Passing the risk

We already mentioned that liquidity providers on DEXes earn their yield by taking on the risk of Impermanent Loss. At their core, all yield sources are just that - parties exchanging risks. This is especially obvious with insurance protocols (e.g., premiums) or derivatives (e.g., funding rates) but applies almost everywhere.

People depositing tokens into lending markets take on the risk of the platform becoming insolvent. There have been many such cases. Some of them were caused by smart contract vulnerabilities or flash loan attacks. Even those staking and delegating are not entirely safe. This is because they usually have to lock funds for extended periods of time and are vulnerable to slashing.

When assessing yield sources and strategies it is important to understand the risks involved. It is also helpful to know who is the counterparty of the risk exchange. There is a famous poker saying - “If you have been in a poker game for a while, and you still don’t know who the patsy is, you’re the patsy”. DeFi adopted it as “if you don’t know where the yield comes from, you are the yield”.

There is no such thing as “risk-free yield” as has been demonstrated by the recent collapse of CeDeFi lenders. If you, however, still decide to venture into the world of DeFi APRs, being aware of the yield sources will always be an important advantage. Even more so in markets like current ones.