Q3 Key Insights

While user activity and TVL were down in Q3, Trader Joe’s consistency in shipping new products contributed to relatively stable fee revenue.

New partnerships saw TJ integrating with a variety of protocols and services, helping to spread exposure to Avalanche to the world outside of DeFi

The protocol continued its push to expand into additional markets, with Joepegs and Joe Studios placing particular emphasis on NFTs.

Joe Pegs in particular experienced astronomical growth in Q3, with sales numbers increasing by 1856% and the number of unique users up by 1056%.

The team shipped a number of upgrades to its existing AMM, enhancing UI on several of its products.

The quarter was spent laying groundwork to prepare for the upcoming release of Trader Joe v2.

Report Content

Introduction

Q3 Intro

Q3 Metrics

Partnerships and Integrations

NFTs

Updates and Features

Q4 and Beyond

Conclusion

This Report was written by the Frogs Anonymous DeFi Research Team

Overview of Trader Joe

Trader Joe is the most actively used protocol on Avalanche and the network’s primary decentralized exchange. Since July of 2021, it has facilitated over $88B in trading and played a pivotal role in the ecosystem’s development. Originally launched as a fork of Uniswap v2 at the height of the alternative Layer 1 rotation, its team has an uncommonly expansive vision for their DEX and is gradually developing a one-stop-shop for any DeFi activities users would perform on the network.

Today, the protocol boasts platforms for swaps, lending, liquidity pool management, and staking, as well as a launchpad and a platform for trading NFTs. The latter has been a particular point of focus in 2022, with the team working to develop not only DeFi infrastructure for the exchange of NFTs, but a creative studio for the design and production of NFT collections with complex and immersive storylines. This orientation towards brand has resulted not only in unrivaled dominance over the exchange of assets on Avalanche, but in a strong cultural moat with a robust and dedicated community. As a project, Trader Joe has grown to its current position through uncommon ambition and creativity, and these qualities continued to manifest themselves in its activities across Q3.

Q3 Summary

The bear market continued in Q3 of 2022 and liquidity continued to retreat from DeFi. While other projects have shut down or migrated to other chains, however, Trader Joe has shifted their focus to building out the protocol and expanding its ecosystem through partnerships and integrations with wallets, data clients, and other vectors by which retail users can gain exposure to Avalanche. As the ecosystem expanded, work continued behind the scenes to make Trader Joe a more complete product, with multiple UI improvements and new features introduced in Q3. This effort extended to the NFT space as well, as they broadened their suite of products by building out the JoePegs exchange and introducing Joe Studios, a design house for the production of narrative NFT collections.

The activities of Q3 show a team that is building a strong base in preparation for the next bull market. This work will culminate in Trader Joe v2, which will introduce their new AMM design and mark the biggest upgrade in the project's history. Trader Joe’s aim is to be not only the leading application on Avalanche, but the leading AMM in all of DeFi. What follows is a detailed report on the steps taken by Trader Joe to achieve this in the third quarter of 2022.

Q3 Metrics

The broader market remained weak throughout Q3, and Trader Joe’s relative performance was comparable to other decentralized exchanges. The protocol did a total of $1.84B in trading volume, averaging a daily volume of $20M. It generated a total of $5.4M in trading fees, which equates to a daily average of $58,600. All of this was done while averaging between 4,000-6,000 daily active users.

In addition, Trader Joe had their own rendition of the Curve wars – dubbed the ‘JOE wars’ – which resulted in 16M JOE being permanently locked, while the supply of veJOE reached 1 billion. This level of activity cemented Trader Joe in its position as one of the top ten AMMs in decentralized finance.

Daily Active Users

DeFi has struggled for most of 2022, with prices and trading volume trending down over the past year. This trend extended to Trader Joe, and its liquidity and user activity performed comparably to similar DEXs around the DeFi space. Despite the overall downtrend in user activity, however, Trader Joe still managed to maintain between 3k-8k daily active users through Q3.

TVL

As liquidity exited DeFi, the overall total value locked in the space plummeted. Trader Joe was unfortunately not immune to this. As total TVL on Avalanche fell 31% through Q3 2022, Trader Joe’s TVL also decreased by 24.8%, sitting at $140.65m by the end of Q3.

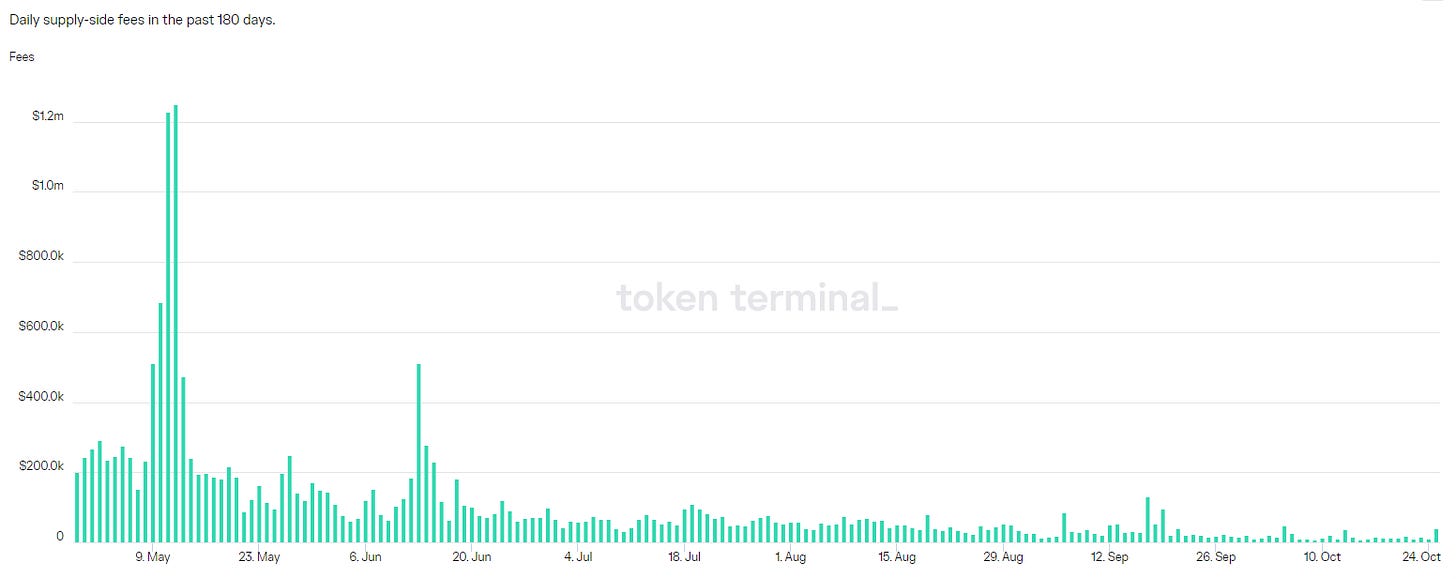

Fees & Revenue

The main form of fee generation is through the fees charged on swaps in the liquidity pools. Through Q3, fee generation remained relatively stable for Trader Joe as they generated $4.2m in fees for the quarter while earning $708k as protocol fee revenue.

LP Fees

In line with protocol fees in Q3, the fees paid to LPs has been $1.5m. The resilience of this fee revenue has allowed the protocol to maintain deep liquidity throughout the bear market, and continue to provide reliable markets for a wide variety of trading pairs.

By volume, the top five of these markets were:

1) USDC.e/AVAX - $448k volume

2) WETH/AVAX - $318k volume

3) AVAX/USDT - $285k volume

4) GMX/AVAX - $274k volume

5) BTC.B/AVAX - $256K volume

Joepegs

One of the bigger highlights for Q3 was JoePegs. Trader Joe played a major role in bringing the Avalanche NFT ecosystem to life, and the performance of JoePegs through Q3 is testament to that.

The total volume on the platform was 88.8k AVAX ($1.4m) which was a 675% increase through Q3. This volume was done on a total of 42.7k sales generating 4.2k AVAX ($66k) in revenue. The sales numbers jumped 1856% through Q3.

The usage numbers on the platform increased by 1056% through Q3 with a total of 34,642 unique users visiting the platform in the 3 month period. These users traded a total of 461 different collections.

Lastly, this expansion can be seen in the royalty figures from Q3. The cumulative market royalties increased 585% through Q3 for a total of 3.48k AVAX ($55k) being generated for the collection owners. These figures are of particular importance as a major source of revenue for artists, as historic royalty stats often influence an artist's decision when choosing a marketplace for their NFTs.

Partnerships/Integrations

Q3 saw Avalanche attempting to expand its footprint both across decentralized finance and into the financial lives of consumers. Trader Joe played a pivotal role in this effort, embarking on a number of partnerships and integrations to increase retail’s exposure to the ecosystem.

July 2022

The month of July saw 3 major partnerships/integrations take place

1. Trust Wallet

Trust Wallet has an estimated 1 million users daily. It rose to popularity primarily due to it being a mobile wallet with a simple UI and high security guarantees. It recently became fully integrated with Trader Joe allowing a whole new set of mobile users to seamlessly interact with the protocol.

2. Autonomy Network

Autonomy Network is a smart contract automation protocol that allows Dapps to seamlessly add new features to their protocol. In the case of Trader Joe, Autonomy helped add limit orders & stop losses. Though ommon features on centralised exchanges, both remain rare on DEXs. This integration proved to be very important in simplifying the user experience by bringing the familiar trading experience of centralised exchanges on-chain.

3. Esprezzo

Esprezzo is a data streaming service with the overarching aim of democratizing access to blockchain data. When it comes to DEXs, data is important for market alerts. The integration with Esprezzo made it easier for Trader Joe users to set up broadly customizable price alerts, improving user experience and granting access to specified data streams.

August 2022

1. Colony Avalanche Index

The Colony Avalanche Index is an index specific to the Avalanche ecosystem built by Colony Labs and Phuture Finance. The index consists of AVAX and other top protocols on the network, subject to monthly rebalancing. In early August it was announced that $JOE will play an integral role in the present and the future of the Colony Avalanche Index, seeing that it is the leading DEX on Avalanche by volume.

2. DeFi.org

DeFi.org launched the Open DeFi Notification Protocol, which gives users mobile notifications of important on-chain events. DeFi.org integrated with Trader Joe to give users real time notifications on things like borrow limit, position value, and new launch events. In addition to this, Trader Joe was also DeFi.org’s launch partner for this mobile app.

3. Wirex

Wirex is an application that allows users to create an account to buy, spend, and sell their cryptocurrencies. Their main feature is the Wirex Card, which allows users to easily spend their crypto in the real world. Wirex made $JOE available on their platform, which now allows $JOE holders to potentially spend their coins with over 81 million retailers.

4. Crypto.com

Crypto.com is a one stop shop for all things crypto, allowing users to store, swap, hold, and spend their cryptocurrencies in one place. The Crypto.com wallet and platform have made a lot of DeFi integrations in the past and recently, Trader Joe was integrated to give their users easy exposure to the Avalanche ecosystem.

5. Silta Finance

Silta Finance is a protocol that aims to bridge the gap between DeFi and traditional finance by connecting DeFi lenders to traditional finance lenders. Their partnership with Trader Joe was centered around the Joe Pegs NFT marketplace, and the two hosted a week-long charity event where NFTs were sold at auction. All of the proceeds generated were given to the Carbon180 NGO.

September 2022

1. Floki

Floki is a project that started off as a memecoin and has now branched out into offering a whole suite of crypto products. One of their recent updates was the introduction of the FlokiFi locker, an LP locker solution which new projects can use to bootstrap liquidity. Trader Joe will be used as the main DEX for FlokiFi, on which the LP tokens will be locked. This not only brings in more liquidity to Trader Joe but also a whole new set of users.

2. BUSD

BUSD is one of the leading stablecoins in the crypto ecosystem. It is issued by Binance and is primarily used on the BNB network. However, in an effort led by Trader Joe, native BUSD was made available for use on Avalanche, making the execution of cross-chain transactions and cross-chain protocols much easier.

3. Forta

Forta is a platform for the development of bots that monitor the health and security of DeFi smart contracts. Trader Joe worked with Nethermind, a developer team within the Forta community, to design bots that monitor ownership transfers on critical contracts, large swaps and transfers, and re-entrancy activity on four contracts deemed to be at risk of token transfer callbacks. These bots are now monitoring these potential operational risks and serving to enhance protocol security.

4. Cask Protocol

Cask is a protocol designed to automate the process of dollar cost averaging on decentralized exchanges. Long used as an investment strategy to mitigate volatility, DCA’ing refers to spreading out bids over time to purchase an asset for the average price over a specified period. Since integrating with Cask, Trader Joe now allows users to make purchases on Avalanche of predetermined size, frequency, price range, and maximum slippage.

NFTs

Through 2021, NFTs were amongst the best performing sectors in the entire crypto industry. The spillover effect is that almost every protocol decided to get involved with NFTs in some way. Ethereum and Solana have always dominated NFT activity with Tezos, Flow, and Binance making up the remaining minority of NFT activity.

Opensea was the marketplace primarily facilitating NFT trading on Ethereum while Magic Eden was the marketplace primarily facilitating NFT trading on Solana. Both of these marketplaces facilitated a combined $35B in volume. Therefore, it only seemed natural for Avalanche to pave their way into this sector. This movement was naturally led by Trader Joe as they set up the NFT marketplace “JoePegs.”

Joepegs

Since its launch, JoePegs has facilitated a total of $2.7 million in volume with total sales standing at 60.7K. The aim for JoePegs through Q3 was to steadily grow the platform as new features gradually got incorporated, and this work saw the platform increase total users by 650% and total mints by 372% through the quarter.

July was arguably the most active month for JoePegs in terms of feature rollouts as well as project launches. 16 new projects went live in the month as the team rolled out six different features for the marketplace. The feature rollouts through July and August played a big role in the user and volume increase that JoePegs saw through Q3, however the team continued to rollout features in September as well.

July

Bulk Listings: NFT collections tend to range from 1k to 10k in collection size. Bulk listings make it easier for projects to upload an NFT collection in one go.

Sales bot: Projects can implement this bot to make it easier for holders and other community members to keep track of sales.

Rarity: Each NFT within a collection tends to vary in traits with rarity being amongst the most important traits. JoePegs made it easy to add different rarity features.

Collection sorting: This is the introduction of filters in a dropdown list to make it easier for users to find different collections that fit their preference. You can sort collections by things like volume, floor price, most minted in 24h and much more.

Shopping cart: The shopping cart makes the browsing experience easier. Similar to how users shop online in web 2, users can add NFTs to their shopping carts and come back to them at a later date and purchase them.

August

Curated collections list: This is simply a tool to make it easier to navigate through the world of Avalanche NFTs. Things like top trending, meme, and much more can easily be filtered for.

NFT reactions: Similar to how people can react to videos and other posts on social media, JoePegs aims to introduce that social element to NFTs making it a more interactive environment between community members and founders.

Bulk Cancel orders: If a user has placed multiple different bids and would like to cancel all of them for some reason, they can do it through just a few clicks.

Project Analytics: The new analytics feature makes it easier to track things like volume and floor prices on different collections.

Sweep tracking bot: Sweeping floors is a popular term in the NFT ecosystem that refers to bulk buys of a particular collection at the floor price. The sweep tracking bot now gives users live updates of collections that are having their floors swept.

Custom Profiles: Similar to how the reaction feature was making the JoePegs experience more social, The custom profile feature allows users to set their favourite NFT as a profile picture and make a username. Users can also link all their social media accounts to their JoePegs account.

Listing depth: This feature was introduced to make the searching and discovery process easier. Users can easily check the amount of listed items at a specific price.

September

English auctions: The process of an English auction goes as follows

i) The creator must set a starting price and duration of auction

ii) Bidders can place bids if the bid is higher than the starting price, 5% higher than the previous highest bid, and if the highest bidder wants to top up, they must add at least 5%

iii) The auction is settled either once the time runs out, or if the creator accepts the most recent highest bid.

Bulk transfer: Users can now transfer NFTs between wallets in bulk rather than one at a time.

Whitelist status badge: Whitelists were introduced as a way to ensure that bots don’t ruin the minting experience and also so that community members who were the most active are appropriately rewarded. Now if a user has earned a whitelist for a specific project, they will get a whitelist badge attached to their account.

Floor price vs mint price: This feature was added to improve upon the analytics that the platforms already offers. Users can compare floor prices vs mint prices on the launchpad page now.

Joe Studios

July also saw Trader Joe launch their very own NFT production house called Joe Studios. The purpose of this studio is to make multiple story-based NFT collections, and a team of storytellers have been assembled to make the collections more meaningful and exciting. Joe Studios has launched three different collections through Q3: Smol Joes, Smol Creeps, and Rich Peon, Poor Peon.

Rich Peon, Poor Peon

This was the first collection launched by Joe Studios and was built around a lore of mining rocks. Poor peons are the ones who do the hard work and mine rocks while rich peons are the quick-thinking ones who turn the smashed rock into cash. It is a collection of 5k NFTs which also has another element to it. The other element is called Beeg Rock. Beeg Rock has a boardroom which is at the top of this entire operation. Only people who had 11+ peon NFTs were given access to this boardroom through invitations. A total of 176 initiations were sent out, and there will never be more Beeg rock NFTs created.

Once you have an NFT and are in the Boardroom, it acts as a group of individuals working together. This group gets benefits such as access to exclusive alpha across the Avalanche ecosystem, receiving whitelists for new NFT projects, exclusive insight for all future Joe Studios projects, access to community events, and giveaways, as well as merch. The ultimate goal is for the group to work together to help each other and make better investments as a cohesive boardroom.

The Rich Peon, Poor Peon NFTs have experienced a total volume of 7046 AVAX, or ~$111k at current prices. The collection has a total of 954 holders and a current floor price of 4.99 AVAX. The Beeg Rock NFTs have done a total volume of 2331 AVAX or $36.8k at current prices. There are currently 169 holders and the NFT has a floor price of 110 AVAX.

Smol Creeps

The Smol creeps collection is made up of 800 NFTs. The story behind them revolves around their purpose as creeps. They are watching people’s every move and keeping an eye on all the scammers and grifters that are around us. The collection features 100 unique creeps, all of which are vastly different from one another. These 100 creeps make up the backbone of the creep community. Accompanying these 100 unique Creeps are 700 generative creeps who are the friends helping in creeping around the crypto lands.

The collection currently has 304 holders and has facilitated a total volume of 3996 AVAX which equates to $63.1k at current prices. The current floor price of Smol Creeps stands at 15 AVAX.

Smol Joes

Smol Joes is a small collection of 100 NFTs. Each NFT grants a holder a spot in the exclusive Smol Joe club. Accompanying these NFTs are the Smol Land NFTs which can be bought by Smol Joe holders. The Smol Joe collection has a long lore to it involving them arriving on the kingdom of We-smol. The lore is constantly updated through comics.

The Smol Joe’s have a total of 82 holders and have facilitated a total trading volume of 14314 AVAX which is around $226k at current prices. The current floor price is 390 AVAX. The Smol Land collection has a total of 200 NFTs and has facilitated a total volume of 10757 AVAX which equates to $170k at current prices. Smol Land currently has 138 holders with a floor price of 38 AVAX.

Updates and Features

As Trader Joe was steadily expanding its horizons through partnerships and strengthening its NFT marketplace and collections, some handy updates were made to the AMM itself to ensure that the user experience continues to improve there as well.

Liquidity Pool UI

The pool page saw a complete change of the user interface to make it easier to understand and interact with. The swap button was also added to the pool page so that if users want to either top up liquidity or search for a newly launched pool, they can do it very swiftly through this new feature. These UI changes were mainly made to simplify the difficult job of being a liquidity provider.

Staking UI

The changes to the staking interface allow users to easily view general staking analytics as well as their personal staking portfolio composition. Users can filter between different timeframes and also check historic APR’s to help them with more in-depth analysis. The fresh look to the UI makes for a more pleasant and aesthetic viewing experience.

Q4 and Beyond

Any developments Trader Joe has on the horizon pale in comparison to Trader Joe v2, slated to be the most significant upgrade in the protocol’s history. Designed by the team from the ground up, v2 will constitute a retooling of the entire Trader Joe platform, anchored by its marquee feature: a new AMM design it refers to as Liquidity Book. In Liquidity Book, the team aims not only to upgrade their own DEX, but to compete with Uniswap v3 and revolutionize the way that AMMs are designed.

The main difference between the liquidity book and other AMMs is the Liquidity Bin model. It is an upgraded version of concentrated liquidity wherein liquidity is divided into separate bins. Each bin acts as its own constant sum market maker pool following the x+y=k formula. Only one bin is used at a time until liquidity from that bin is used up, then price moves to the next bin.

By concentrating liquidity in this way, LB dramatically reduces the amount of impermanent loss endured by liquidity providers. Moreover, because changes in asset price will result in different bins being used for swaps, the rate at which the AMM cycles through bins provides a reliable indicator of volatility. Trader Joe refers to this indicator as the volatility accumulator, and v2 will factor its data into its new, variable fees on asset swaps. Because impermanent loss is largely caused by divergence in asset prices and exacerbated by volatility, this variable fee feature will essentially reimburse LPs, mitigating the amount of IL they experience during volatility.

The overarching aim of the Liquidity Book is to give traders a decentralised exchange which offers zero-slippage trades while liquidity providers get more customizability over position composition as well as higher fees earned. Once the liquidity book goes live it is not only likely to increase trading volume from Avalanche native users, but also attract a whole new set of users to Avalanche. No slippage trades will attract higher volume, and more profitable liquidity providers will mean there is more liquidity in the bins. More liquidity can facilitate even higher volume which means LPs can earn more, therefore incentivising them to add more liquidity kicking in a flywheel of growth that will potentially attract a swarm of new users.

Conclusion

In conclusion, despite market-wide headwinds in Q3, Trader Joe saw a number of positive signs that indicated high performance relative to its peers. While TVL and price fell alongside most other DeFi protocols, the ongoing growth of its fee revenue is cause for celebration and the explosion of activity on Joe Pegs testifies to the product’s value to the ecosystem. Its emphasis on creativity – both in the work of its NFT studio and in the innovative design of its upcoming AMM – points to a team that is comfortable thinking outside the box and is likely to attract and maintain an enthusiastic community as a result. Looking forward, Trader Joe v2 is right around the corner. The building is set to continue in Q4 and the future remains bright for Avalanche’s golden child.

This Report was written by the Frogs Anonymous DeFi Research Team

Trader Joe is a one-stop-shop decentralized trading platform native to the Avalanche blockchain. Trader Joe offers a comprehensive DeFi platform where you can Trade, Lend and Leverage, participate in a Launchpad and shop for NFTs. Visit Trader Joe and discover what DeFi can really offer.