The rumour mill has been swirling, but it’s finally here. After much wait, we’re proud to launch the third installment of Joe - Token Mill, a Bonding Curve Automated Market Maker, which is now live on Solana, marking our debut there.

Token Mill was launched on the 13th of November and is currently having key integrations worked on for the platform to flourish on Solana.

What Is It?

Token Mill is a platform that offers a secure and flexible solution for token creation and exchange. It is designed to help creators launch a token for any kind of project, whether it’s a simple memecoin or a fully fledged DeFi token.

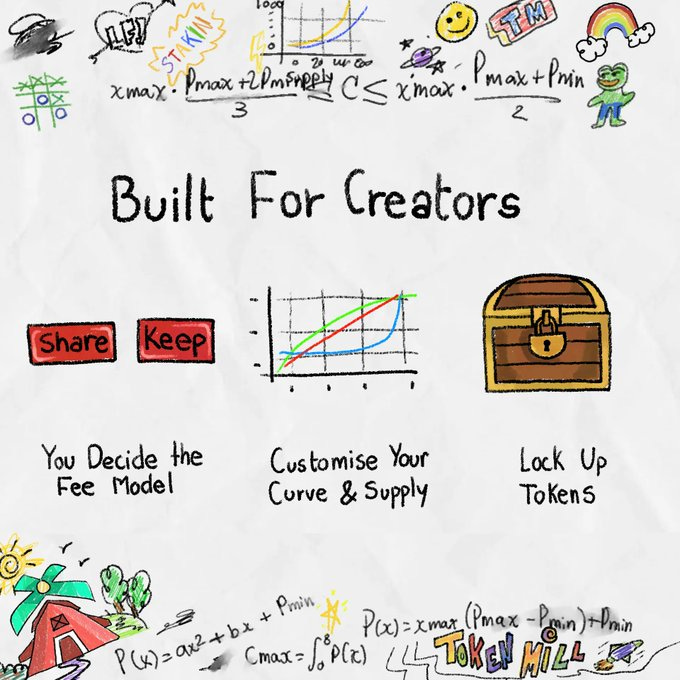

As a creator, you can create token markets where:

You earn all the trading fees

Price follows any bonding curve you design

Allocate yourself tokens via a customizable lockup and vesting schedule

We believe it’s vital to also align the interests of the community, so as a token holder you can earn a share of fees by:

Staking your tokens

Referring your friends

And since fees are only levied on buys, the result is a creator <> community flywheel where both are incentivized to drive as much demand as possible to the token. To top it off, the liquidity pool is never migrated; its entire lifecycle can always remain on Token Mill.

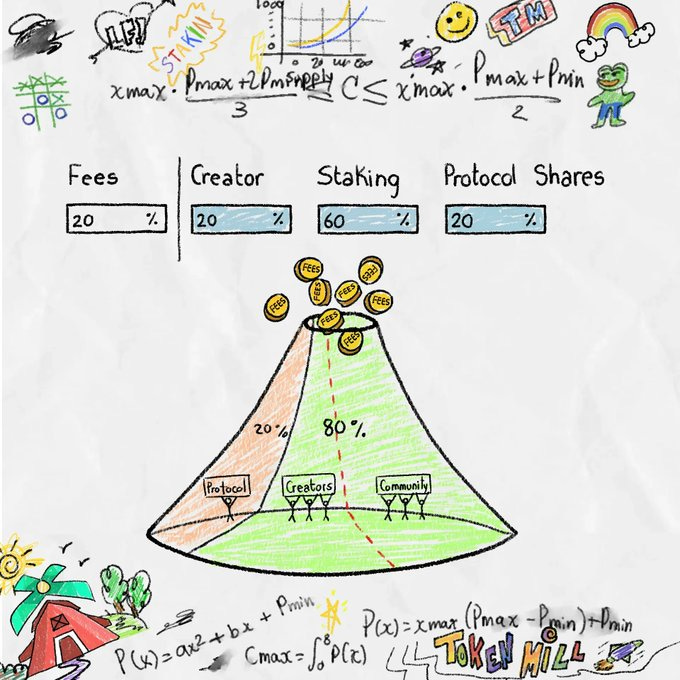

Fees For YOU

In Token Mill, whether you are a creator or a buyer, you **earn the fees. Token Mill takes a 20% platform fee, half of which goes to the referrer (if any). The remaining 80% is allocated according to the creator’s preference, which is split between creator and stakers. Thus as a buyer, you can go on to earn fees from two avenues: staking or referring. In other words, your community is incentivized to stake and shill, empowering them from mere passive holders to active ones who are aligned with the creator to drive growth.

In addition, fees are only levied on buys, further aligning both creators and holders to ignite demand.

Use Any Bonding Curve

Uniswap V2 made liquidity provisioning easy with its xy=k bonding curve. Unfortunately, it also meant every token shared the same price sensitivity to token demand, rendering them all identical other than the name and symbol.

Token Mill evolves this one step further - creators can specify any pricing function for their bonding curve, making each token launched on Token Mill truly unique, as the price of each token will react differently to demand.

For simplicity’s sake though, we’ve provided a few function templates for you: quadratic, exponential, power and logarithmic. However, you’re perfectly free to design your own. If you’re a math nerd and enjoy playing on Desmos, then this feature will delight you the most! We look forward to all the funky bonding curves you come up with.

Token Locker

Token Mill was built for all token creators whether it’s a solo memecoin founder or a team working on a DeFi token. Regardless of the nature of your project, all great teams need long term alignment in the form of token allocations without fear of getting dumped on from the community. Therefore, we’ve added team token allocation and lockups so holders can ape safely knowing that creators are in it for the long haul and they’re not going to get dumped on day 0.

Last Resort Liquidity That Never Moves

Token liquidity always stays on Token Mill and is never migrated. The tokens however, act like a regular token and can be used to seed liquidity pools on other DEXes like Raydium. In fact, as the market cap of your token grows, we envision the majority of trading to occur on a CLMM DEX where traders can get a better price with the Token Mill liquidity serving as a market maker of last resort.

Trusted Links

Please be cautious of any and all links, save the below links as the official LFJ shared URLs.

Platform Link: https://tokenmill.xyz/

User Documentation: https://token-mill.gitbook.io/token-mill

Developer Documentation: https://docs.tokenmill.xyz/

Token Mill Community: https://t.me/+pB0uP3RLIihhODA0