On-chain limit orders are now live on Trader Joe!

This innovative feature allows traders to set automated buy or sell orders that execute with no fees or price impact. Trader Joe is one of the first Decentralized Exchanges (DEXes) in the space to implement fully on-chain limit orders.

This development ensures:

No reliance on external oracles

Your trades have perfect execution

Swaps with no additional fees or price impact

Complete decentralization ‘on-chain’ execution

Unlike centralized exchanges, Liquidity Book doesn't charge any fees on limit orders. Plus, there is no price impact or slippage on swaps when using the limit order feature making it a highly efficient option for trading. There are two types of limit orders that open up new strategies and offer more flexibility and control for your trading and liquidity providing: Place Orders and Pool Orders.

Place Orders

Place Orders are executed at your chosen specific price point. Your tokens are automatically deposited into a liquidity pool. If your price point is hit, your position will convert to your desired tokens and be held, waiting for you to claim them.

Place Order: Buy

You can buy the lows by setting a desired price below the current market price. If the price of that asset decreases and hits your target price, and your position is fully filled, your order will execute. Your tokens will then be held, waiting for you to claim.

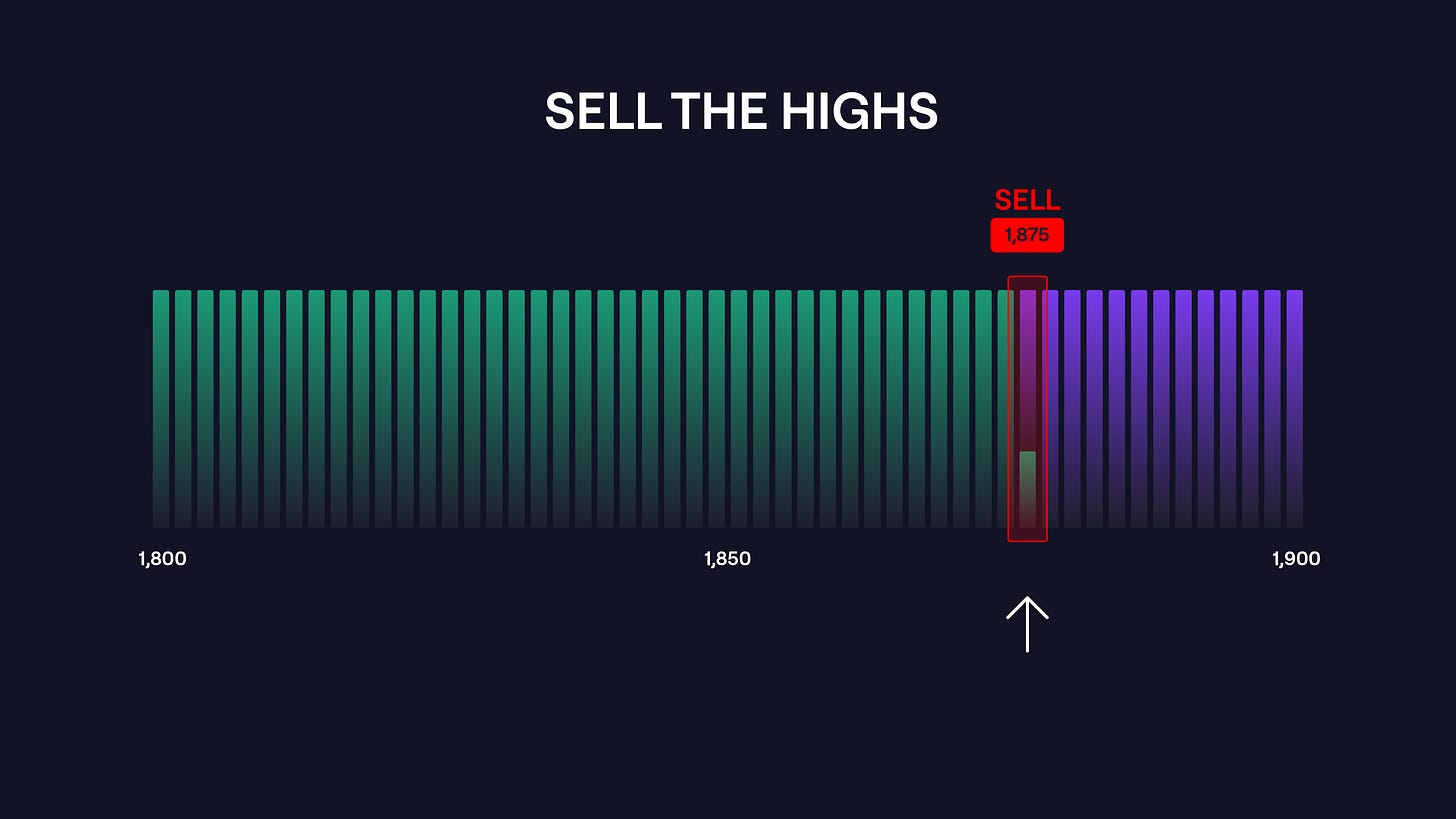

Place Order: Sell

By setting a Place Order above the current price, you will automatically sell your tokens once the price point hits. You can claim your tokens from the filled order at any time.

Strategies you can deploy

Capture Arbitrage

By combining two or more Place Orders, traders can run automatic arbitrage strategies. For example, you can set up a Buy and a Sell order to capture stablecoin depegs.

Grid Trading

Take advantage of the short-term volatility between support and resistance levels. Continuously sell the highs and buy the lows by placing multiple Place Order instructions at defined intervals.

Pool Orders

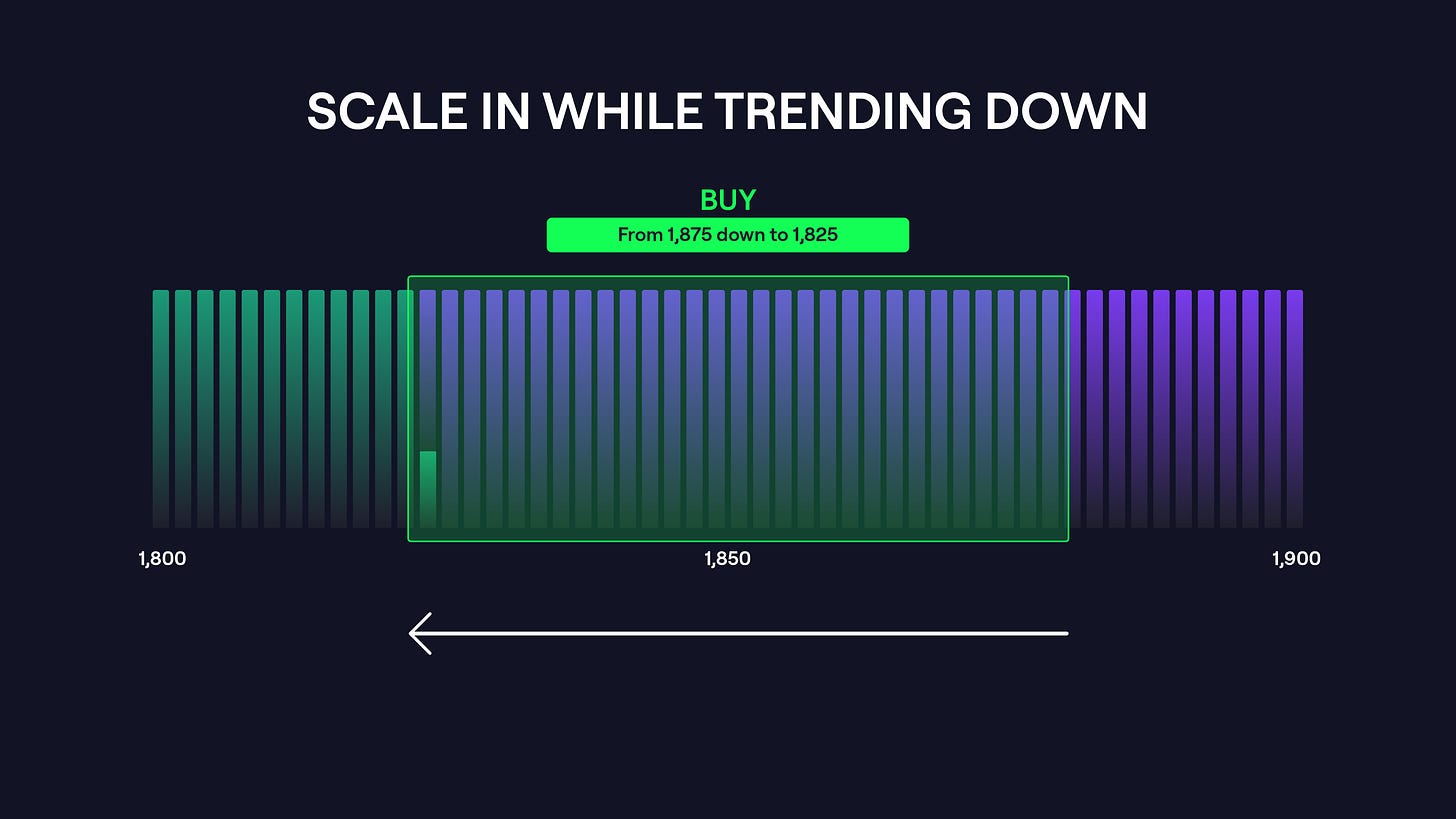

Using the Pool Order feature, you can deposit liquidity across a specified range. Your order is filled gradually, as the price moves inside your range. Pool Orders are an excellent way to automate your Dollar-Cost Averaging (DCA) strategy to enter or exit a token, with no fees or price impact.

Pool Order: Buy

Pool Orders are especially effective for scaling into tokens, particularly when dealing with large positions. They effectively eliminate any price impact you would typically get when swapping.

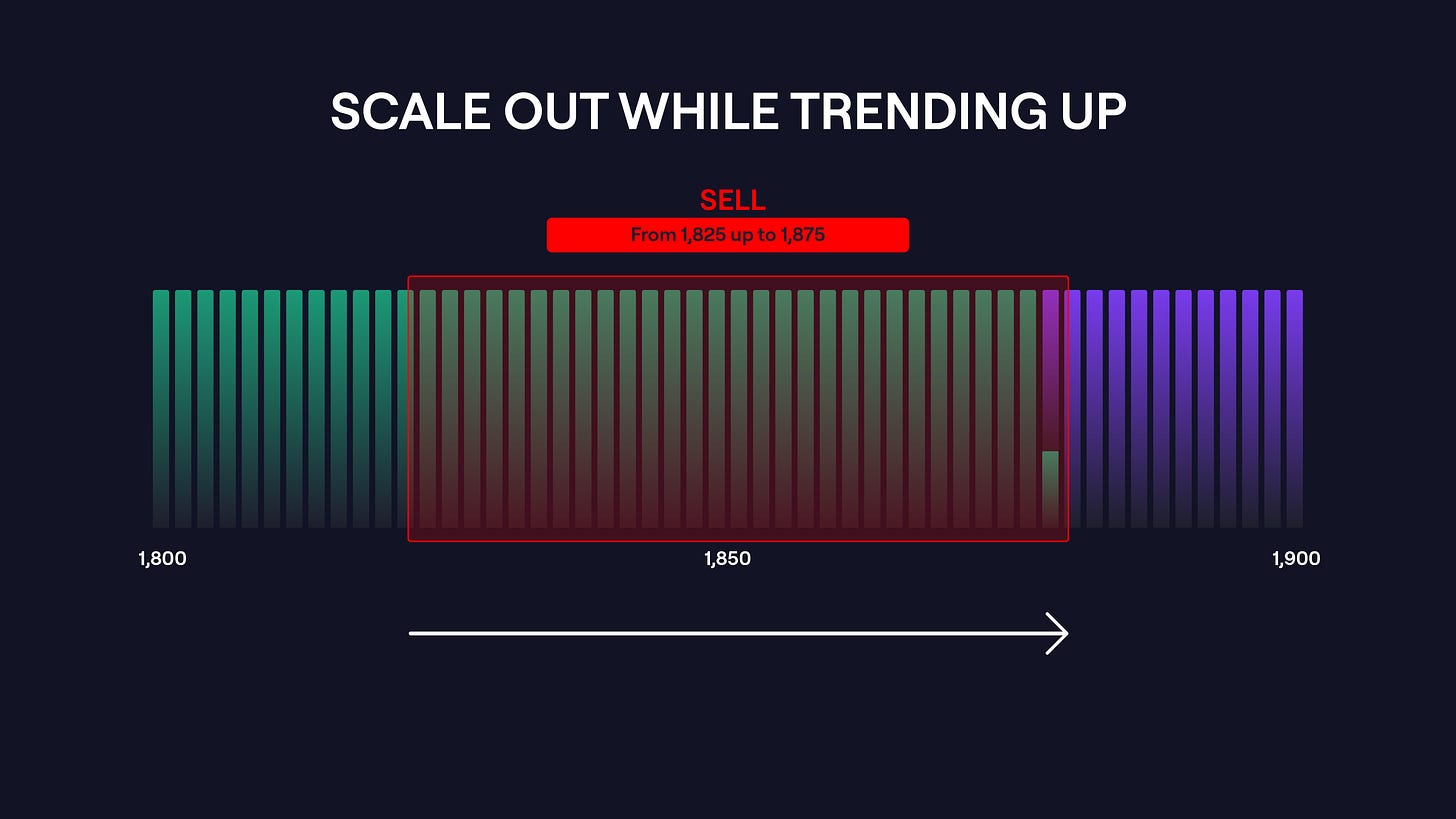

Pool Order: Sell

Similar to a Buy, you can set up a Pool Order to automate your exit from a token. This feature is particularly useful with large positions, as there are no fees or direct impact on the price.

Why use Limit Orders?

Both Place and Pool Orders execute trades with zero slippage, taking advantage of Liquidity Book and the fully on-chain architecture. Users are free to combine both Place and Pool Orders with the regular Liquidity Providing (LP) strategies to enhance risk management helping to protect their positions from Impermanent Loss.

Trader Joe makes DeFi easy and accessible

The introduction of fully on-chain Limit Orders is yet another step Trader Joe takes to empower Liquidity Providers and Traders. Now, you can not only trade your favorite tokens at market prices, but also run much more advanced strategies in a safe and permissionless manner. Start exploring this powerful feature and elevate your trading strategies today.

📊 Trade: Home page

About Trader Joe

Trader Joe is a leading multi-chain decentralized exchange and the inventor of Liquidity Book, the most capital efficient AMM in DeFi. Trade your favorite tokens, access one-click yield farming and shop for the latest digital collectibles at the Joepegs NFT Marketplace. DeFi has never been easier thanks to Trader Joe.