The Llama that is certainly not OffRegularly

OffRegularly was captivated by the promising world of DeFi 2.5 years ago, drawn in by the productive nature of yield farming. His journey started with a group called YieldFarming.com, which served as his gateway into DeFi.

Over time, OffRegularly's interest and involvement in DeFi expanded, much like the vast appetite of a Llama. This expanded interest led him to seek out flourishing pastures across various blockchain ecosystems, such as Avalanche, Polygon, and Arbitrum. Here, he found new opportunities and continued to broaden his DeFi expertise. He became proficient with managing concentrated liquidity positions and leveraging his market making skills over time, he has now found preference in focusing his market making with highly correlated pairs, using Liquidity Book.

Q: Talk me through your daily routine as a retail market maker?

Now that I have a day job again (as a hedge fund trader), my ability to maintain market making positions for my on-chain crypto is severely limited as I really only get to log in when I get home after work. So I would say my routine is less interesting than before and the bar to market make is much higher than ever.

Q: What are your key market making strategies on Liquidity Book?

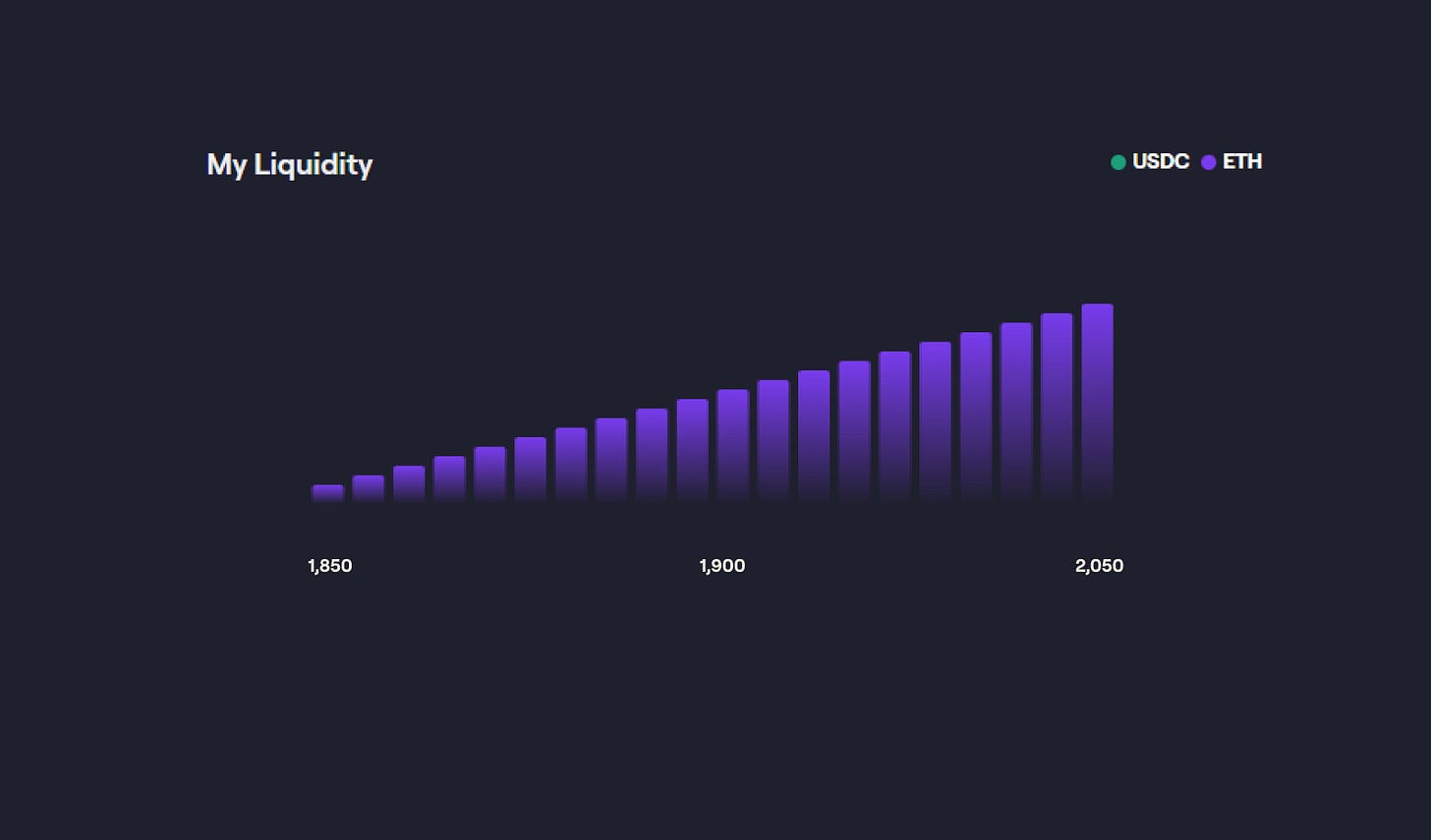

I frequently engage in market-making for ETH-USDC because I use it as a tool to trade in a range-bound market, a trend we've witnessed for most of this year. As for altcoins, I primarily engage in market-making when I have a near-term bullish view on a specific altcoin. In such cases, I would buy into the altcoin and then use Liquidity Book to sell out of the coin when it ranges upward. This strategy is particularly why Liquidity Book is great, as it allows me to easily deploy the right type of liquidity shape that suits my strategy.

Q: Can you describe an instance when a sudden market event (like a flash crash or sudden price surge) affected your market making activities? How did you manage it?

Usually downtrades hurt the most as alt coins underperform ETH, and when these occur, it becomes a tougher decision as whether to chase the market lower or just cut losses. I’d say 60% of the time I stick with it, using the next small uptick in the alt coin to fully reduce my market making position, then walk away.

Q: Reflecting on your journey as a market maker, if you had the chance to travel back in time, what key piece of advice would you offer to your past self?

Market making always feels a lot easier in an up-market, but volume in a range-bound market is the holy grail of market making pairs. Once I limited myself to pairs that correlated well, I had much greater success. (i.e. It’s really not easy to market make Volatile-Stable, so it’s often best to steer clear).

Q: What is your approach towards managing impermanent loss?

The key to managing IL is to minimize rebalancing. This can be very tough, but it most often comes down to correctly setting a wide band within which you market make. Each rebalancing means you are locking in your IL, and while I’m not saying I never do it, I try my best not to unless I find that my market making range is just obviously wrong.

Q: Do you use any key tools or services to help inform your market making strategies?

I am a trader by profession, so I think my brain is programmed to think about market making from a trading perspective. I generally only use graphing tools to determine market making ranges, and try my best to market make in coins that I have a view that have a high likelihood of trading higher. However, for my ETH-USDC pair, which is active all the time for me, I simply market make across the range knowing that I’m basically buying low and selling high, as long as I believe we are going to stay in the range (which I still feel is the case).

Q: Any last words of advice or inspiration?

Being a liquidity provider but not knowing if you have time to manage your pools is probably a very dangerous duality.

Unlock the power of DeFi, with Trader Joe

Feeling overwhelmed by market making in DeFi is completely understandable. Recall the initial confusion when you delved into Web3? It seemed challenging, but here you are now! Your presence here reading this article is proof of your perseverance. As demonstrated by OffRegularly, adopting a technical-led approach and remaining focused on executing that strategy is the most effective route to a fulfilling market-making journey. Always bear in mind to only accept risks within your capacity, and when in doubt, don't hesitate to join Trader Joe's Discord to chat with one of our moderators.

Useful Links:

About Trader Joe

Trader Joe is a leading multi-chain decentralized exchange and the inventor of Liquidity Book, the most capital efficient AMM in DeFi. Trade your favorite tokens, access one-click yield farming and shop for the latest digital collectibles at the Joepegs NFT Marketplace. DeFi has never been easier thanks to Trader Joe.