Introduction

Liquidity Book (LB) is an innovative protocol launched by Trader Joe that creates paired asset markets through the aggregation of discretely priced bid-ask liquidity bins. Liquidity providers on LB have full control over the pricing of their assets rather than having to subscribe to a single pricing algorithm as is prevalent in other DEXs. This means each LP acts as an independent market maker on LB.

Market participation is required for LB to provide competitive asset pricing and low slippage to traders for the listed markets, much like a CEX. In order to incentivize healthy participation, bi-directional liquidity, and market uptime, Trader Joe will be rolling out incentives through the LB Rewards Program.

MakerScore

The LB Rewards program will score participants based on factors that stimulate efficient markets. MakerScore is calculated using the fees collected by the LP and the bidirectional book depth they provide over a defined epoch. MakerScores are calculated independently for each rewarded market over the rewarded epoch. Rewards are distributed based on each participant’s relative performance against all eligible LPs (for each market).

Epochs

Participation is evaluated over a defined time period to encourage regular and consistent market making. Epoch length may change with time and may vary across markets, but will likely be within a target range of 1 week to 1 month. Epoch start/end dates will be announced before they begin along with the reward amounts.

MakerFees

The most important market contribution of an LP is the volume that they support/generate. LPs are rewarded with fees on swaps against the liquidity that they provide, so fees can be used in place of volume as a participation metric. Further, the dynamic fee mechanics incorporated in LB increase fee rates during volatile conditions (ie for filling large orders). Therefore, LB fees themselves are an excellent measure of the market activity for an LP. Fees represent volatility weighted volume and serve as the first term in the MakerScore calculation.

MakerFees will be also used as an eligibility filter for the reward program. To be eligible for rewards, the provider must accrue >1% of total fees paid in the market during the epoch.

MakerTVL

TVL Sampling

TVL will be sampled every minute and assigned to the below categories:

Spot: Liquidity in the active bin

Bid: Liquidity within -5 bins of the active bin

Ask: Liquidity within +5 bins of the active bin

TVL outside of +/-5 bins will not contribute to MakerTVL. The 1 minute samples (j) will be averaged over each hour (h) to get a time-weighted average of each category for each hour. The total number of hours in each epoch is represented by N.

MakerTVL

To encourage consistent bi-directional liquidity, only the minimum of average bid or average ask liquidity for each hour will be credited to the maker. This minimum value is added to the average spot liquidity to arrive at a single MakerTVL value for each hour. MakerTVL is then averaged over the epoch.

Epoch Rewards

Maker Rewards

LB Rewards are siloed by market for each epoch. Reward amounts will be announced prior to the epoch’s start. MakerScores are calculated independently for eligible LPs and rewards are distributed based on their proportional MakerScore in each market.

Partner Rewards

Partner rewards may also be used to incentivize liquidity in LB markets. The LB Reward program provides a market maker scoring rubric and generic reward distribution for those incentives. Contact BD to explore partnerships.

Reward Claiming

LP rewards will be calculated off-chain and distributed through a general rewarder contract that enables vesting and collective claiming. Rewards will vest over a specified duration which will be at most the duration of the epoch. Maker scoring and rewards calculations will be completed off-chain but will be published from community review.

Example Epochs

To illustrate how MakerScores and rewards are calculated, refer to the two examples below:

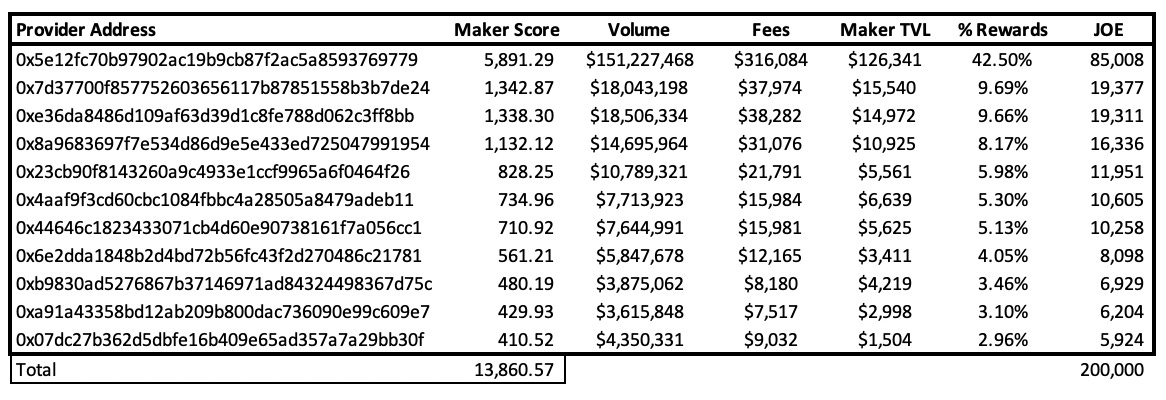

Example 1: AVAX-USDC (Avalanche) Jan 1, 2023 - Jan 31, 2023

Using data available on a Tableau dashboard, during this market & period there were 11 LPs that would have been eligible for rewards (accruing more than 1% of total fees paid). If 200k JOE had been rewarded for the epoch, their MakerScores and rewards earned would have been as follows:

Example 2: Multiple Markets and Rewards

Assume rewards are announced to be the following for an upcoming epoch:

AVAX-USDC (Avalanche): 200k JOE + 500 AVAX

BTC.b-USDC (Avalanche): 200 AVAX

ETH-USDC (Arbitrum): 200k JOE

GMX-ETH (Arbitrum): 50k JOE + 100 GMX

Alice (an LP) provided liquidity in 3 of those markets (AVAX, ETH, and GMX) and achieved a relative MakerScore (Alice’s MakerScore / sum(eligible participant MakerScores)) of 10%, 50%, and 20% respectively.

Alice’s rewards would have been 130k JOE, 50 AVAX, & 20 GMX

Next Steps

With reward calculations completed off-chain, we have sufficient flexibility to adjust the LB Rewards program as we evaluate its impact on market participation. I expect there to be some level of tuning and back-end work before we consider it ready for full deployment. Therefore, we are launching this as a pilot program with a limited set of markets.

Another central component to the LB Rewards program will be how veJOE is integrated. We do have plans on this integration which are outside the scope of this pilot, expect more information to come.

LFJ